RINs: Renewable Gas as a Revenue Source

The biogas industry is ripe for trading renewable identification numbers, or RINs, a natural gas currency that is commanding record-high prices as of this article’s publishing (February 2018). For municipal wastewater treatment facilities, public or private landfills generating biogas, or for businesses—such as dairy farms and breweries—that treat high-solids wastewater with anaerobic digestion and generate a biogas byproduct, RINs present a lucrative opportunity. Instead of converting that biogas into onsite electricity or flaring it into the atmosphere, biogas generators can upgrade the gas, sell it into the energy grid and add a strong revenue stream to their bottom line.

How Do RINs Work and What Return Can You Expect?

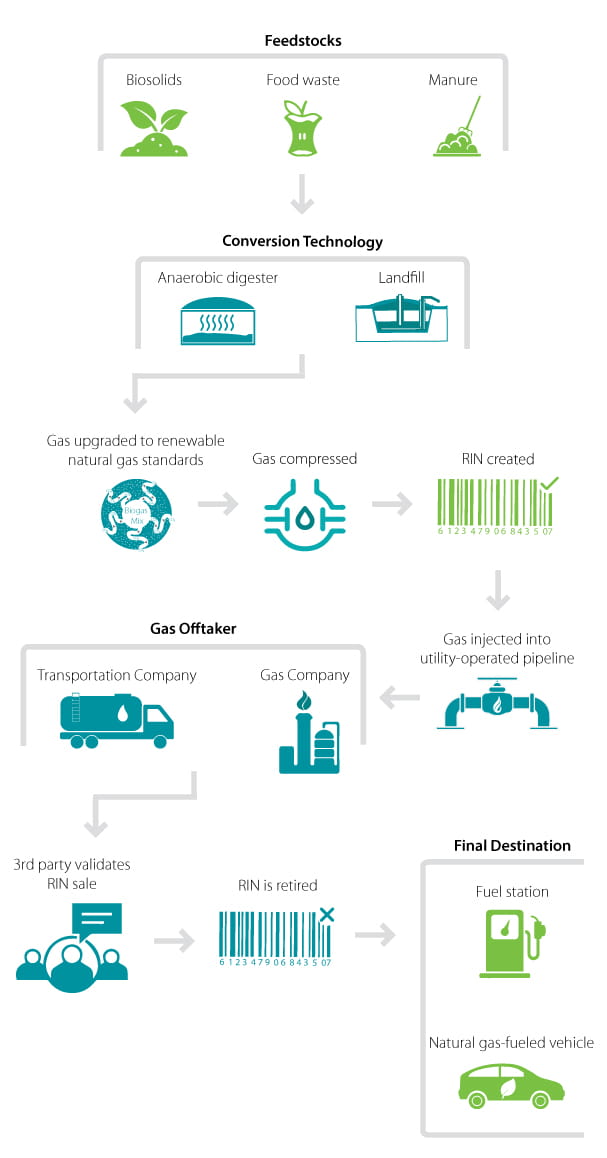

The market for RINs is enabled by the U.S. Environmental Protection Agency’s (EPA) Renewable Fuel Standard (RFS). RINs function like renewable energy credits. They are tradeable commodities; each RIN is proof that the equivalent of a gallon of renewable natural gas has been injected into a shared pipeline. According to our experts, there are 10 primary steps in the creation and journey of a RIN.

The journey starts with a feedstock (e.g., biosolids, manure, food waste) that is converted into natural gas via a digester or landfill gas capture. That gas is then upgraded to meet renewable natural gas specifications, compressed and then injected into a utility-operated gas pipeline. Next, a gas off-taker, such as a fueling company, purchases the RIN. With the help of a RIN validation partner—who provides quality assurance and control for the sale—the RIN is then retired, and the natural gas is transferred to either a gas filling station or to a natural gas-fueled vehicle.

The RFS outlines four categories of renewable natural gas that can be traded as RINs. Each is named with the prefix “D” and a number: cellulosic biofuel (D3), biodiesel (D4), advanced biofuel (D5) and corn-based ethanol (D6). The most attractive RINs to the biogas industry are D3 and D5 RINs due to the EPA-registered “pathways” available for biogas producers to generate D3 and D5 renewable fuels. (Pathways are technological processes that meet EPA standards for carbon reduction.)

D3 RINs, specifically, have a significant revenue upside. Prices at the end of 2017 reached highs of $39 per one million British thermal units (MMBTUs) worth of D3 RINs.

D3 RINs, specifically, have a significant revenue upside. Prices at the end of 2017 reached highs of $39 per 1 million MMBTUs worth of D3 RINs.

What is Driving this Trend?

There are two primary drivers. The first is a push to reduce greenhouse gases—a major goal of the RFS along with expanding renewable fuel production and reducing foreign oil dependence.

The second factor is the economy’s shifting preference for natural gas as an energy source. In the last 5 years, natural gas prices have dropped approximately $10 per unit from $14 to $4 . This decrease has made it much more affordable for companies—from waste haulers to goods movers— to choose natural gas over diesel when fueling their trucking fleets. UPS is one example, announcing an agreement to buy 10-million-gallon equivalents of renewable natural gas through 2024 for its trucks.

Though the Trump administration opted the United States out of the Paris Accords in 2017, the RFS-enabled RIN marketplace is authorized through 2022. That gives biogas generators at least 5 years to take advantage of RINs. Meanwhile, California has instituted its own low-carbon fuel standard to reduce the impact of transportation fleets and is offering grants for renewable fuel production. While the RFS’ life is uncertain beyond 2022, the move by California (and states looking to emulate its lead) implies that the desire for increased renewable natural gas production is strong.

What Technology Do You Need to Trade RINs?

Since not all biogas is created equally, the technology you choose to upgrade it will depend on your situation. The four main technologies used to upgrade biogas to renewable natural gas standards are membrane separation, pressure swing adsorption, amine scrubbing, and water wash. The major goal of each technology is to scrub carbon dioxide to purify methane present in the biogas and increase energy content. Selecting the right technology depends on system size, gas quality and pretreatment requirements.

Choosing the right upgrading system can be difficult but is necessary to produce renewable natural gas that reliably meets EPA’s specifications. Once that system is operational, though, biogas producers can enter the RIN pool and take advantage of this lucrative market, while contributing to a fuel economy with fewer emissions and a smaller environmental footprint.