Using Scenario Planning to Understand COVID-19 Impacts to the Toll Industry

While financial and economic experts may argue whether the current pandemic is truly a “Black Swan” event, all agree COVID-19 is impacting our nation’s toll facilities. The uncertainty of this pandemic continues to beleaguer leaders at every level, but one thing is clear. The far-reaching impacts are real and no industry is unaffected. A letter to Congress from the International Bridge, Tunnel & Turnpike Association (IBTTA) requested nearly $9.3 billion in flexible federal funding to restore critical lost revenues across the nation’s 342 toll facilities.

As a traffic and revenue market leader, CDM Smith assembled thought leaders, toll planners and engineers, and data and financial experts to help clients navigate these uncertainties by doing what we have been doing for decades: forecasting and modeling, using real-world data, applying potential scenarios, and performing dynamic analysis. The following provides a glimpse into what we think could be the new normal for many toll facilities.

An Unprecedented Decline

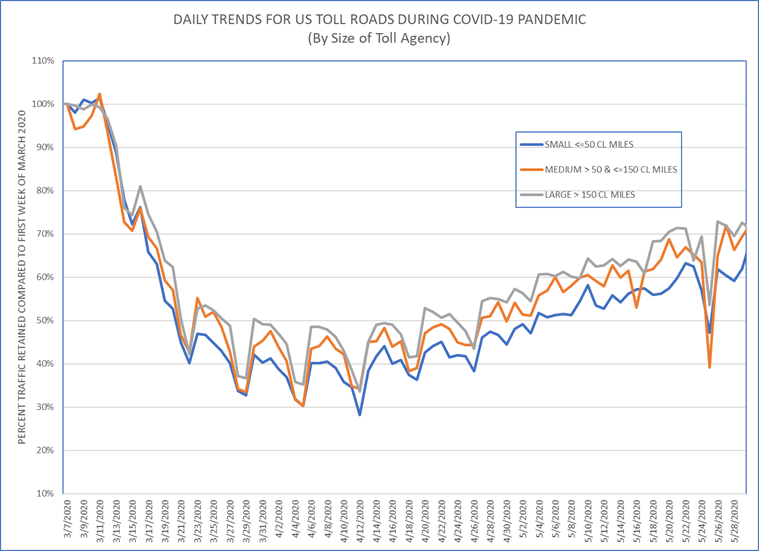

Using data from 14 toll agencies throughout the country, our experts observed the daily road performance from March 1 to June 30, 2020. As a baseline, the study included four large agencies (operating over 150 centerline miles, including interstate and urban facilities); two medium-sized agencies (comprising between 50 to 150 centerline miles of primarily urban facilities); and eight small systems (consisting of less than 50 centerline miles, that serve mostly urban travel and single facilities).

Figure 1 presents a summary of that data, and specifically shows a steady decline in transactions, with a general plateau in mid-April, indicating an average loss of 60%. Since then, we saw a gradual recovery of traffic with an average loss of around 35% when compared to normal levels. However, we have seen a resurgence in COVID-19 in certain parts of the U.S. in July and seen the recovery in traffic stall in those affected areas.

Maximum losses of around 75% were observed for toll agencies within the small system category. This may be a function of shorter trip lengths within urban areas and more toll-free alternatives. We noted that roadways serving special generators such as airports and tourist/recreational centers were significantly impacted.

Toll agencies within the medium category experienced maximum losses of around 55-60%, which was not surprising, given that their portfolio of roadways reside primarily within urban areas.

Toll agencies within the large system category showed an average traffic decline of 50%, indicating a stronger likelihood of resiliency than the small or medium systems. This may be due to the higher proportion of long-distance trips related to inter-city travel and a higher proportion of commercial traffic.

Given the sample size, managed/express toll lane performance was not analyzed. However, in reviewing select datasets, and understanding that toll-free general-purpose lanes experienced little to no congestion, we estimate that traffic on managed/express toll lanes was down by about 75-85%. Taking into account that dynamically priced express lanes have seen lower toll rates during the downturn, we can assume that revenue impacts for some facilities have been even more severe.

The Fall and Recovery

Approaches to Forecasting

Because of the disruption and uncertainties surrounding COVID-19, forecasting is more complex than ever before. In order to address the uncertainty and quantify potential outcomes, our experts applied scenario planning tools. These include scenarios based on our best understanding of current travel restrictions that are mandated, followed by different phases of activity that will gradually be permitted. For each of these phases, duration and severity of traffic impact are projected, using a disaggregate basis (typically weekly) for a period of 24 months. Given the uncertainty related to how this pandemic will play out, multiple scenarios can be developed assuming different phases of recovery, varying the duration and severity of impacts. The starting point for analysis is to obtain actual traffic trends by vehicle type during the affected period.

With the combination of COVID-19 travel restrictions and economic impacts, the latest economic forecasts focus on Gross Domestic Product (GDP), unemployment, and industrial production data. Prior recessions, particularly the Great Recession of 2008, help inform how these indices correlate to traffic performance on toll roads by vehicle type. As travel restrictions begin to relax, the impact of the economic slowdown and travel behavior changes will become more visible.

The pace of recovery will depend on the increased perception of safety by travelers through the availability of reliable testing, therapeutics and vaccines.

Adapting to Change

Toll Agencies

At the outset of the COVID-19 declaration by U.S. health officials, toll agencies reacted quickly, requiring non-essential workers to work from home. Many agencies constructed secure networks to continue administrative, customer service, financial, and engineering functions remotely. In many cases, customer service centers were already operating remotely. Several toll facilities with cash collection suspended these operations, relying on customers to submit toll payments online, providing license plate lookups, or license plate tolling invoicing options. It is unclear whether all agencies were equipped to handle the volume of license plate transactions and processed by the back office, thereby, creating some concern for a possible rise in toll violations. But this will probably not be evident in the data for a while longer. A small number of facilities continued cash collection, providing toll collectors protective masks and gloves. One facility suspended toll collection completely.

For agencies already considering going cashless, the effects of COVID-19 may prove to be a catalyst for a more permanent change to All Electronic Tolling (AET). Regardless, it is likely that several changes will be implemented to better prepare for future disruptions. As a first step, we believe the following is needed:

- Physical and computing infrastructure assessments to ensure system strength and capability to capture license plate images and automatic vehicle classification systems, as well as back office processing for automated invoice generation.

- Network architecture evaluations to confirm the ability of both roadside and back office systems to sustain new business rules.

- Thorough evaluation of communication networks, bandwidth, and data storage capacity to assist agencies with increased data volumes generated by video transactions.

- Secure access to networks and databases for remote working. This may include activities such as image processing and operation of call centers.

Impact on Toll Revenue

Initial assessments indicate that toll agencies will likely experience a 25-35% decline in toll revenue in 2020. The economic recovery will be slow through 2020, continuing through 2021, resulting in an estimated negative impact of 5-10% to toll revenue, when compared to 2019 levels. Despite this, most public-owned toll agencies have maintained strong balance sheets, in addition to maintaining debt service reserve funds typically equal to or exceeding 12 months of cash backlog. Agencies also have the flexibility to reduce or push back expenditures on capital programs and operations until traffic and revenues stabilize. With interest rates at historic lows, there may be opportunities to refund existing debt or seek new funding. Finally, most toll agencies have toll rate setting flexibility, which can offset traffic declines.

Following the 2008 recession, toll facilities demonstrated resilience and stability in the long-term, and we remain optimistic that will be the case after COVID-19.

Given the uncertainty related to how this pandemic will play out, multiple scenarios can be developed assuming different phases of recovery, varying the duration and severity of impacts.

For agencies already considering going cashless, the effects of COVID-19 may prove to be a catalyst for a more permanent change to AET.